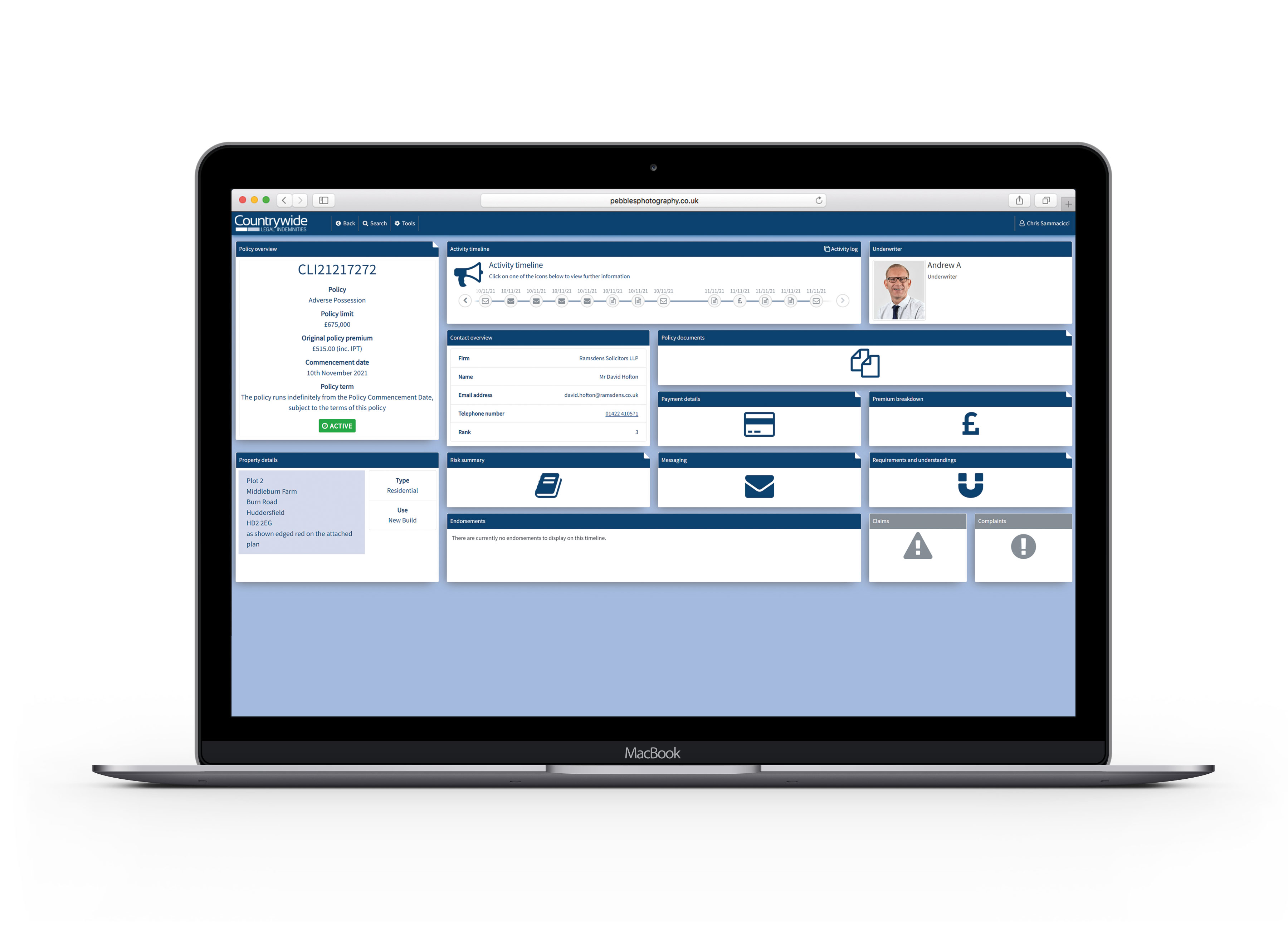

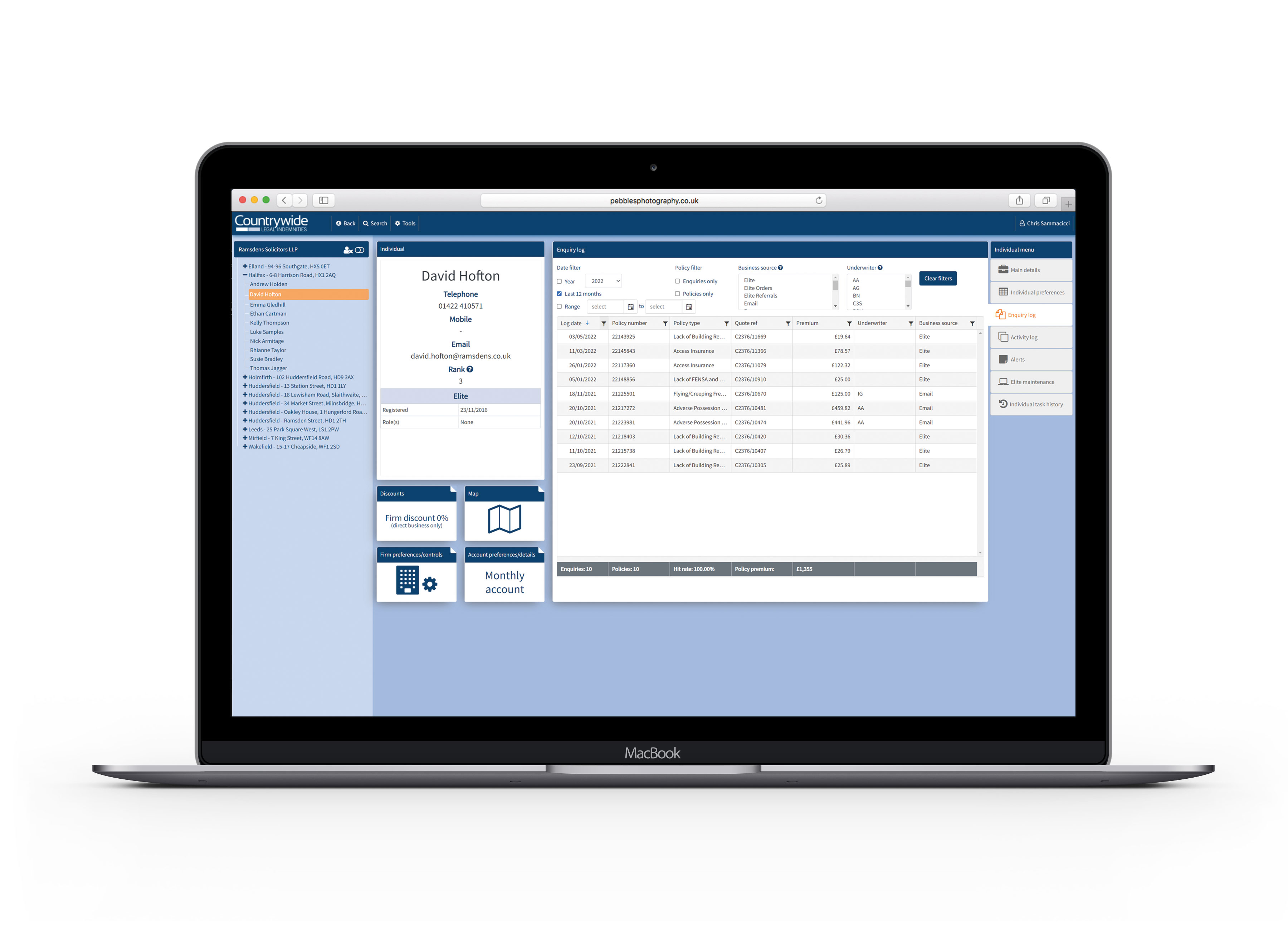

The CRM system at Countrywide Legal Indemnities served as the central hub for managing customers, policies, enquiries, audits, underwriting details, documents, and claims across the organization. This comprehensive platform touched every operational workflow—from initial customer enquiry through policy issuance, premium calculation, document management, and claim resolution.

However, the legacy interface was fragmented and visually inconsistent, with information scattered across disconnected screens using outdated design patterns. Staff struggled with cluttered layouts, unclear navigation hierarchies, and unpredictable information placement. The challenge was to create a modern, intuitive, modular interface that could support multiple user roles while maintaining the complex functionality the business depended on.

The redesigned system includes policy overview dashboards, comprehensive customer profiles, enquiry management logs, activity timelines, underwriting summaries, premium breakdowns with clear calculations, document libraries, and detailed activity logs—all unified under a consistent, scalable design system.